Author: Amanda Beesley | Vice President of Consulting | Aspire

Sponsored by: O’Neil Digital Solutions

The Evolution from CCM to CXM

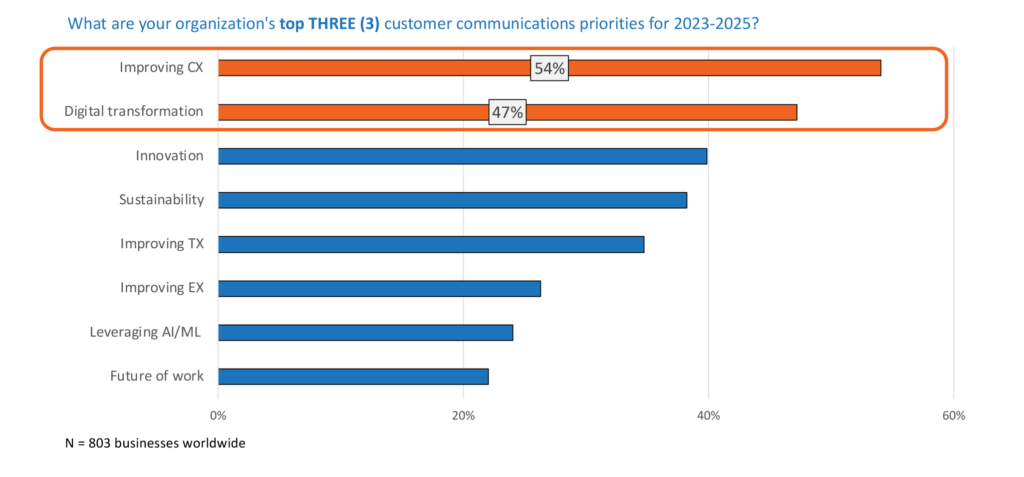

In the rapidly evolving landscape of financial services, a new paradigm has emerged, one that places customer experience (CX) at the forefront of business strategy. This new frontier is no more evident than in the arena of customer communications. In today’s fast-paced digital world, financial institutions are transforming their communication strategies to meet the changing needs and evolving expectations of their customers. Since the unprecedented market disruption in 2020, corporate communications priorities and investments have remained focused on digital transformation and improving customer experience.

This evolution is driving an accelerating shift from Customer Communications Management (CCM) to a more comprehensive Customer Experience Management (CXM) approach. A key component of this transformation is the growing importance of in-depth consumer insight and data to help craft these superior customer experiences. The ability to leverage data for personalized interactions is becoming a critical differentiator in the financial services sector.

The Rising Importance of Personalization

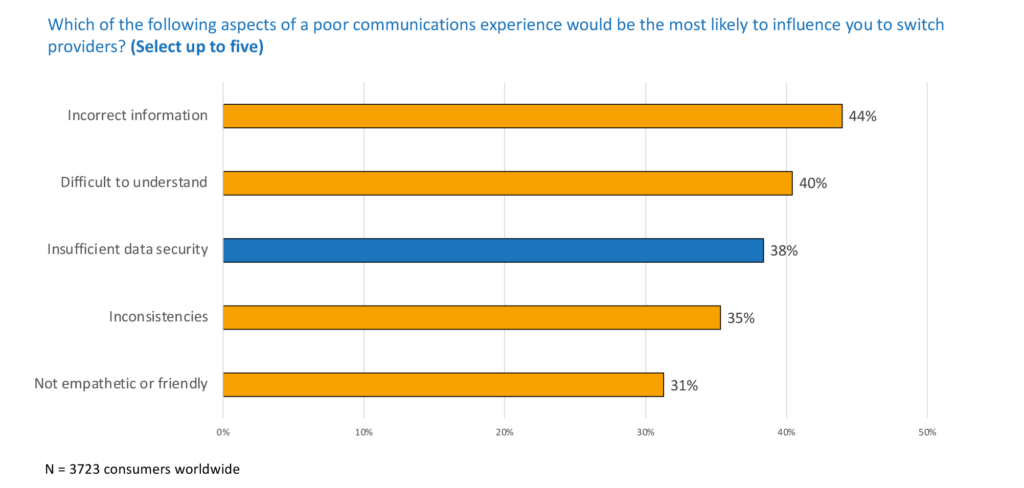

Aspire’s 2024 global research has shown that one in five consumers worldwide switched providers in the last year because of poor communications experience, including over a quarter of Millennials and Gen Z. Four out of the top five negative aspects consumers say would lead them to switch providers relate to the content of the communications.

Consumers living in homes with the highest income demand relevant, consistent, and easy-to-understand communications on their chosen channels while more highly educated consumers value correct, consistent, secure, and concise interactions. These insights underscore the importance of robust and consistent customer experience and the growing need for CX platforms to help facilitate true one-to-one communication with consumers. We’re seeing the growing development of these platforms, which include comprehensive capabilities aligned to manage and enhance individual consumer experience across the entire experience lifecycle. By leveraging these capabilities, financial institutions can successfully drive higher levels of digital adoption through improved engagement, ultimately enhancing loyalty, growing revenue, and reducing costs. The ability to communicate on a truly personal level with each customer is rapidly becoming a key differentiator in the competitive financial services market.

Therefore, the transition from CCM to CXM is not just “nice to have” – it is instead an imperative in today’s competitive landscape. Our analysis indicates that financial organizations are increasingly working to leverage comprehensive databases as part of wider CX platform initiatives. These platforms must empower users to collect, analyze, and apply customer data across various touchpoints, enabling a more holistic and personalized approach to customer interactions.

Creating Seamless, Personalized Experiences

Data: The Cornerstone of Enhanced CX

The Convergence of Marketing and Regulatory Communications

Navigating the Regulatory Landscape

The Future of Financial Services CX

- AI-powered personalization: Advanced AI algorithms will enable even more sophisticated personalization, predicting customer needs and preferences with incredible accuracy. Reliable data sources are the key to this future.

- Real-time adaptation: CX platforms will evolve to adapt in real-time to customer behaviors and market conditions, ensuring interactions are always relevant.

- Beyond factual data, financial institutions will increasingly look to incorporate emotional intelligence into their CX strategies so that they can recognize and respond to a customer’s emotional states.

- Predictive financial guidance: Leveraging big data and AI, institutions will offer proactive, personalized financial advice that can help customers make better financial decisions.

- Seamless omni-channel experiences: The lines between digital and physical channels will continue to blur, creating truly integrated experiences across all touchpoints.

Conclusion

About O’Neil Digital Solutions

A Word from our Sponsor

About Aspire

Author

Want a PDF of this whitepaper?

Simply complete the form and we’ll email a secure link to download the whitepaper.